transcript below

Hi everyone and thanks for joining me. Today we’re talking about: Socially Responsible Investing. With all the changes happening, investing in sustainability for our communities and our planet is a big deal. For the first time in 134 years, the U.S. is now using more energy from renewables than coal for example.i

Whether you use this approach in your financial strategy or not, it’s important to know what choices you have. So, what does it mean to invest responsibly? Here are the categories:

- ESG Investing (Environmental, Social, Governance)

- These three central factors determine the viability of the societal impact of a particular investment.

- Impact Investing

- These investments seek to combine a societal benefit with a potential financial return.

- Socially Responsible Investing

- Here you can think of “green” investment focuses like solar, wind, clean water and so forth.

- Philanthropy

- These target longer term, measurable impact on a particular cause or group that you’re looking to help.

Source: Morningstar, Wikipedia

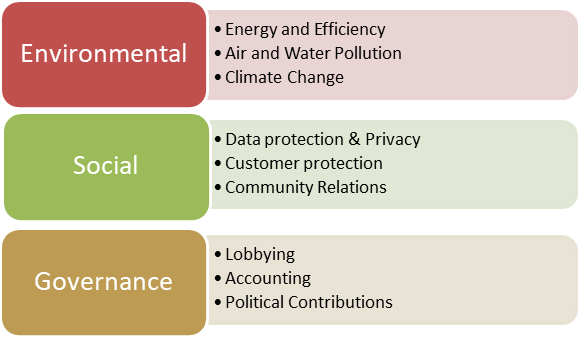

If we just look at ESG for example, here’s what’s included:

To sum up: there are many different responsible investing options. The trend of doing good for our society while simultaneously doing good business, is exploding. Not only for investors, but companies and leaders as well. As more people want to associate (and invest) in companies with a positive impact on our planet, it will make our world a better place.

That’s’ all for this edition! Thanks for listening!

Information has been obtained from sources believed to be reliable, but is not guaranteed. The opinions and predictions expressed are those of the author solely and not necessarily the opinions or expectations of Cottonwood Wealth Strategies. No predictions or forecasts can be guaranteed.

This material does not constitute a recommendation to buy or sell any specific security. Past performance is not indicative of future results. Investing involves risk, including the possible loss of a principal investment.